Session 6 - Navigating the upstream and dowstream value chain

The digital sector relies on a large number of materials and components produced by the electronics industry. As digitisation and the demand for components increase, so does the need to create new factories, whether for electronic chips or even the end-of-life processing of all this equipment. Let's navigate the environmental challenges present at each stage of the value chain.

Lifecycle of a product

Lifecycle of a product

See the supply chain of Fairphone 4

1 - Raw material extraction

We have already explored this stage during Session 5.

2 - Raw material processing

This section uses the research paper from Gauthier Roussilhe, Thibault Pirson, David Bol, Srinjoy Mitra, titled: Purer than pure: how purity reshapes the upstream materiality of the semiconductor industry) (Link to preprint).

We have already seen the huge variety of materials involved in the digital value chain. We also examined the challenges associated with extracting these resources. However, the volume of material extracted for digital applications is limited compared to global extraction rates. Recently, a new approach has emerged that considers the specificities of the upstream semiconductor value chain, which is often not located at the extraction site, but at the stage of raw material purification.

The most recent data from the United Nations show that the value of key elements used for the Information and Communication (ICT) technologies such as gallium (Ga), germanium (Ge), indium (In), rare earth elements (REEs), selenium (Se), tantalum (Ta) and tellurium (Te), only accounted for 0.77% of all elements mined in 2018 (excluding coal) [7]. Although it is undeniable that ICT goods and services would not exist without the production of the mining industry, its mineral demand seems at first sight limited. To have a more comprehensive picture of the materiality of the digital sector, a complementary perspective further exploring production chains is needed. [...] Microchips are arguably the most complex artefacts human beings have ever made, and the ones that require not only the largest variety of elementary material, but also with ultra-high purity requirements.

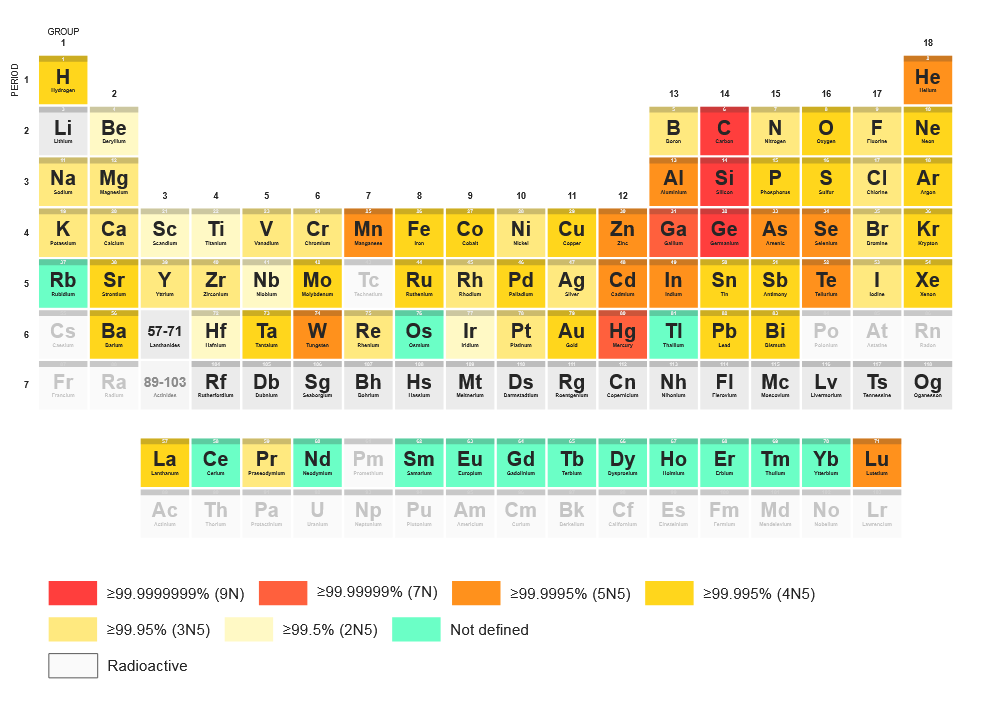

Non-exhaustive summary of the main elements used in the semiconductor industry (upstream). Purity requirements for the element are indicated by shades of orange

Non-exhaustive summary of the main elements used in the semiconductor industry (upstream). Purity requirements for the element are indicated by shades of orange

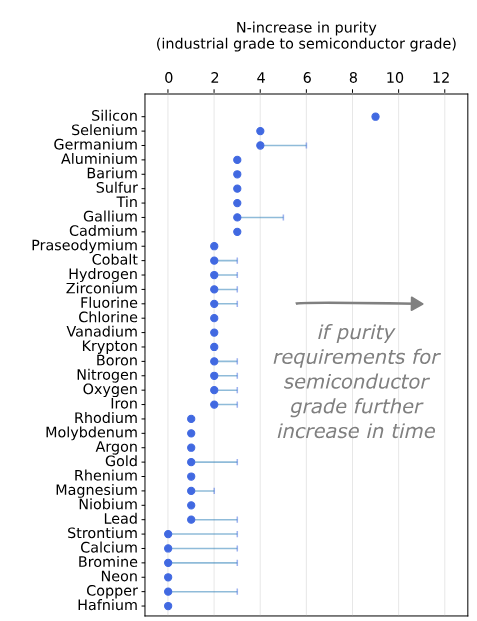

Comparison between standard grade and electronic/semiconductor grade on a selection of elements. The light blue bar indicates the variability in the calculation, where either the maximum semiconductor-grade or the maximum non-semiconductor purity is not clear from the literature.

The case of silicon

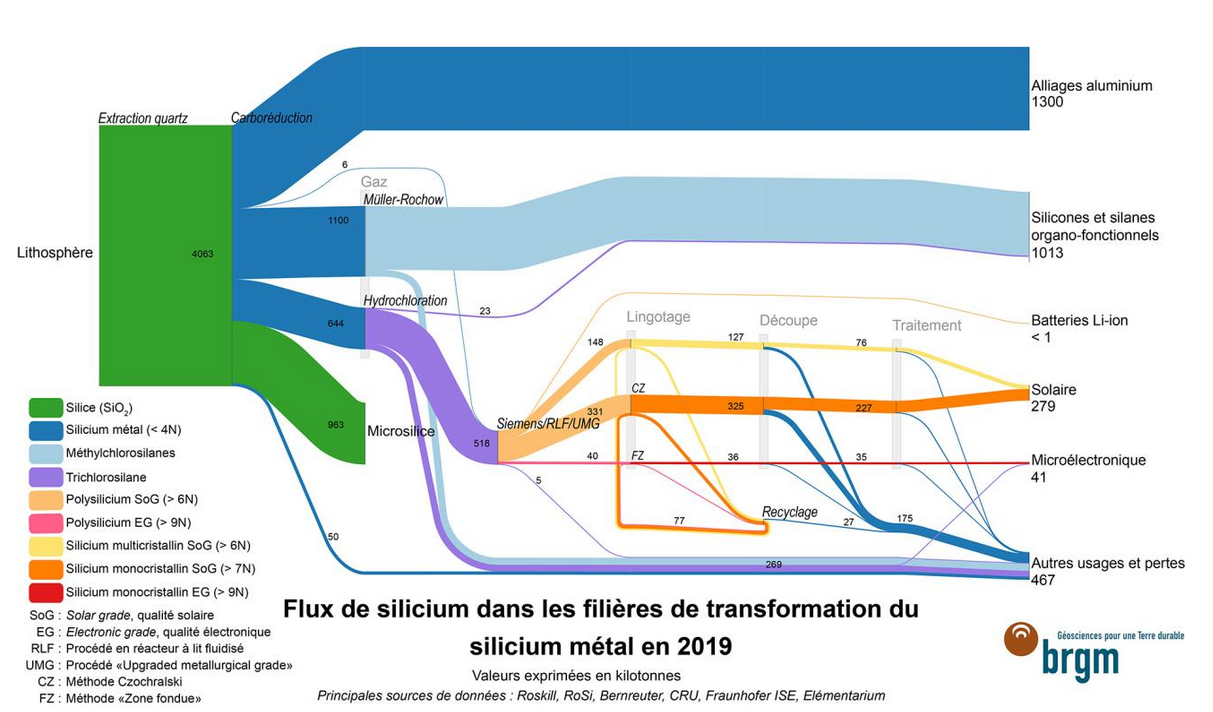

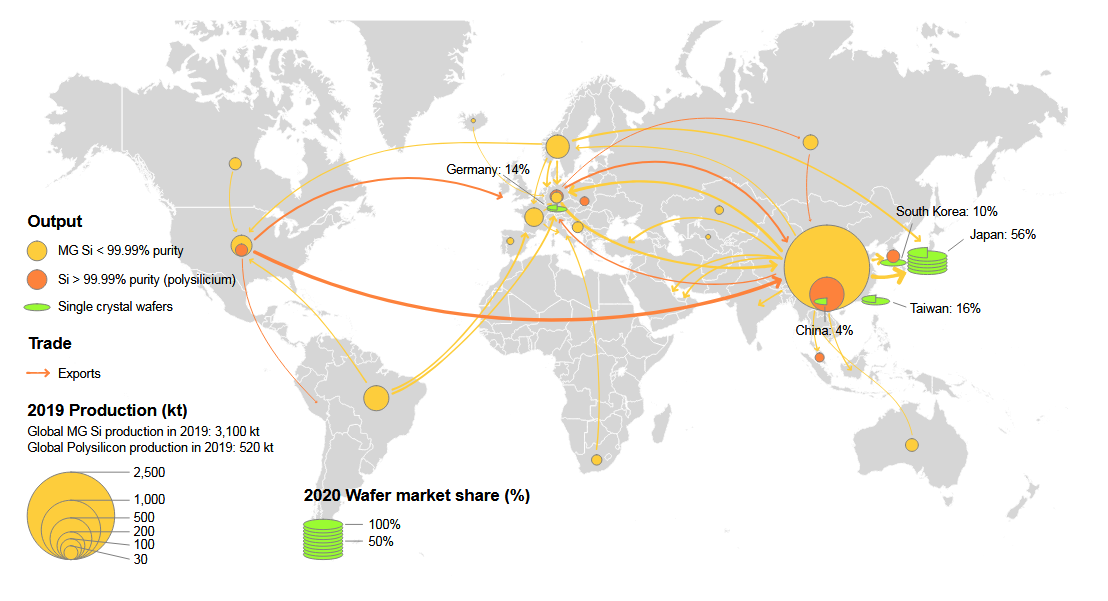

Silicon flows in silicon metal processing chains in 2019, BRGM (link)

Silicon flows in silicon metal processing chains in 2019, BRGM (link)

Silicon is without doubt one of the best-known elements in the digital sector and at the heart of the modern electronics industry. Nevertheless, only a fraction of the silicon extracted is used by the electronics industry. According to the French Geological Survey (BRGM), while 4,093 kilotons of quartz were extracted in 2019, only 41 kilotons went into the electronics industry, or about 1% of the total flow [24]. This element is more characterized by the purity required than by the quantity extracted. It is one of the elements with the highest purity requirements in the semiconductor industry, 11N (99.999999999%) or even higher. Numerous industries are therefore required between the extraction of quartz and the production of ultra-pure silicon. [...] The case of silicon shows how the demand for purity quickly isolates upstream supply chains, as illustrated in Figure 6. This highlights two critical issues. First, it appears that the geographical concentration of the early stages of purification is in China, like many other elements. In 2023, it was estimated that China represented more of 90% of the polysilicon production market shares [25]. Then, the concentration of more than half of the production of single-crystal wafers is held by two Japanese companies, Shin-Etsu and SUMCO [26]. [...] According to our estimates, there are only 35 factories worldwide capable of producing single-crystal wafers, and even fewer capable of producing wafers for advanced semiconductors (300 mm) (see Supplementary Materials). The ultra-pure silicon production value chains are a typical example of a small group of countries’ mastery regarding the material basis of the digital sector. In this case, the increasing demand for purity is exacerbating bottlenecks, which creates scarcity even for an abundant element such as silicon. Furthermore, such purity requirements have a significant environmental impact, particularly the transition from polysilicon to single-crystal silicon [27].

Production of silicon metal and polysilicon in 2019 and market share in wafer manufacturing in 2020 (BRGM)

3 - Manufacturing

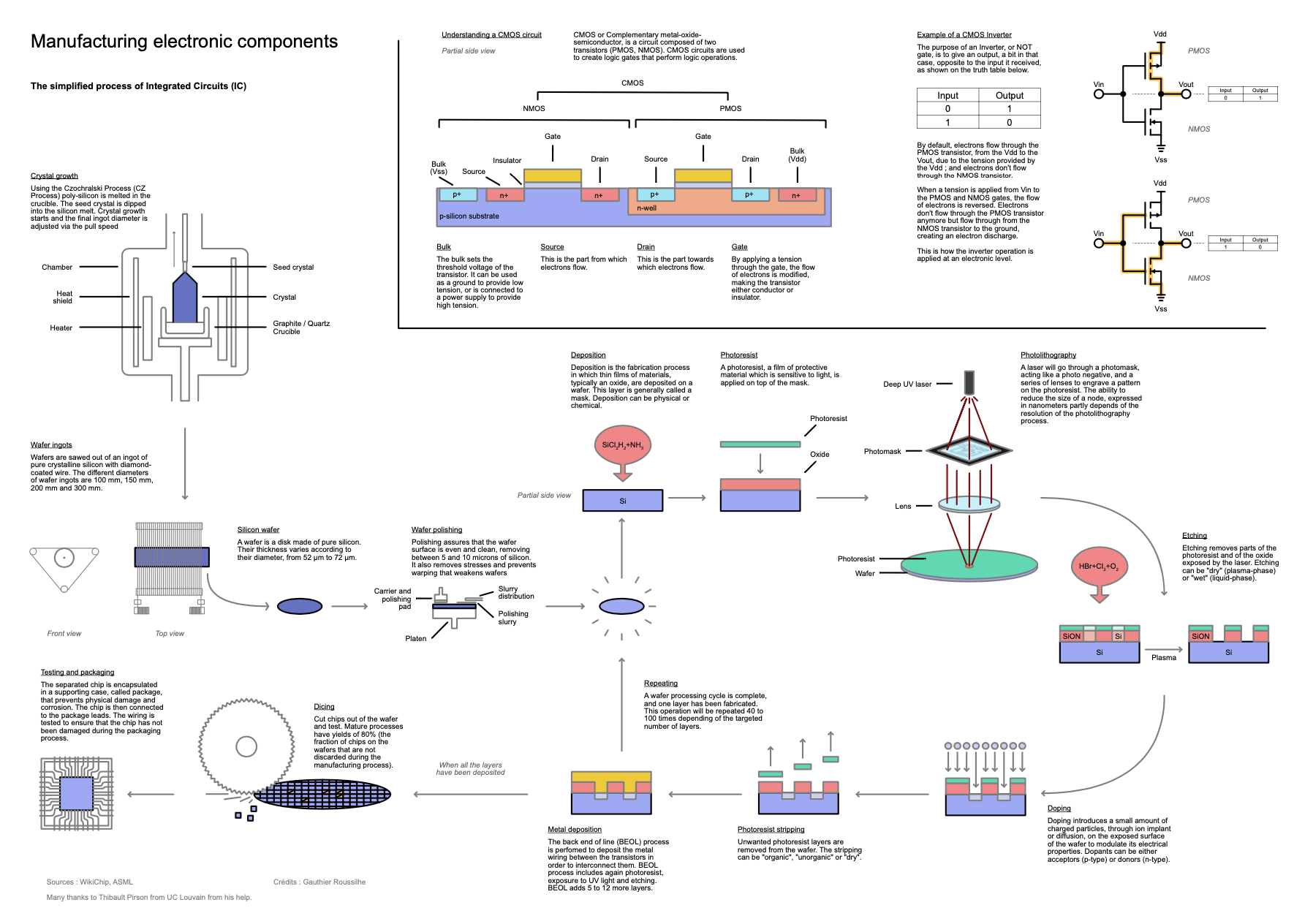

Making electronic components

Before going any further it is necessary to have a basic understanding of what electronic components are and how they are made. Electronic components are generally classified into different families according to their function and physical properties. There are many ways of classifying them but there are three main categories: active components (diodes, transistors, ICs, optoelectronics, displays), passive components (resistors, capacitors, sensors, etc.) and electromechanical components (switches, fuses).

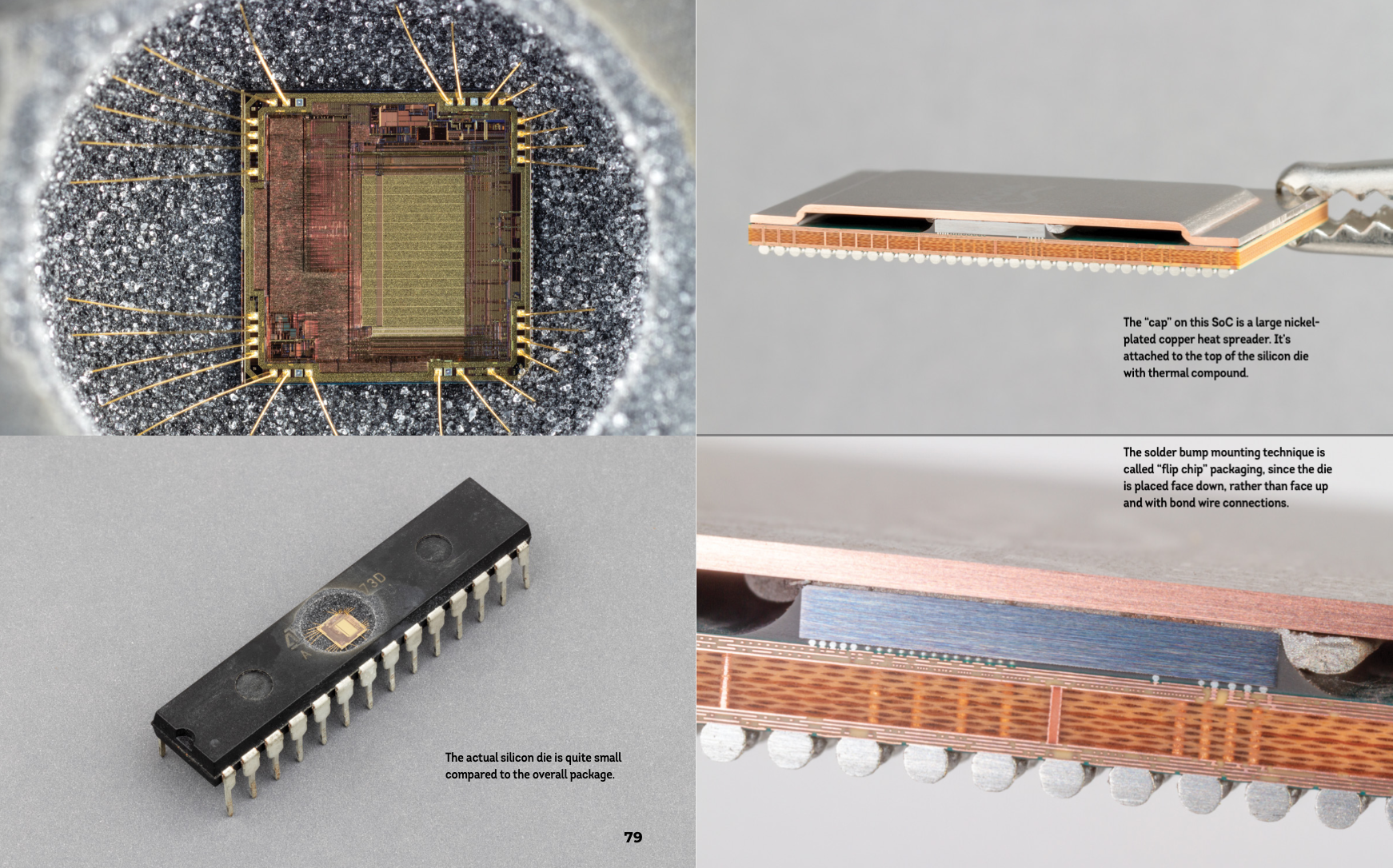

Close-up of a microcontroller (left) and side view of a microprocessor (right) - Credits: Eric Schlaepfer and Windell H. Oskay

Within the integrated circuits there are still different families, called logic, i.e. with logic/electronic gates (diode/transistor/resistor logic). The integrated circuits that interest us are the CMOS (Complementary Metal Oxide Semiconductor) logic components used for microprocessors or memory components.

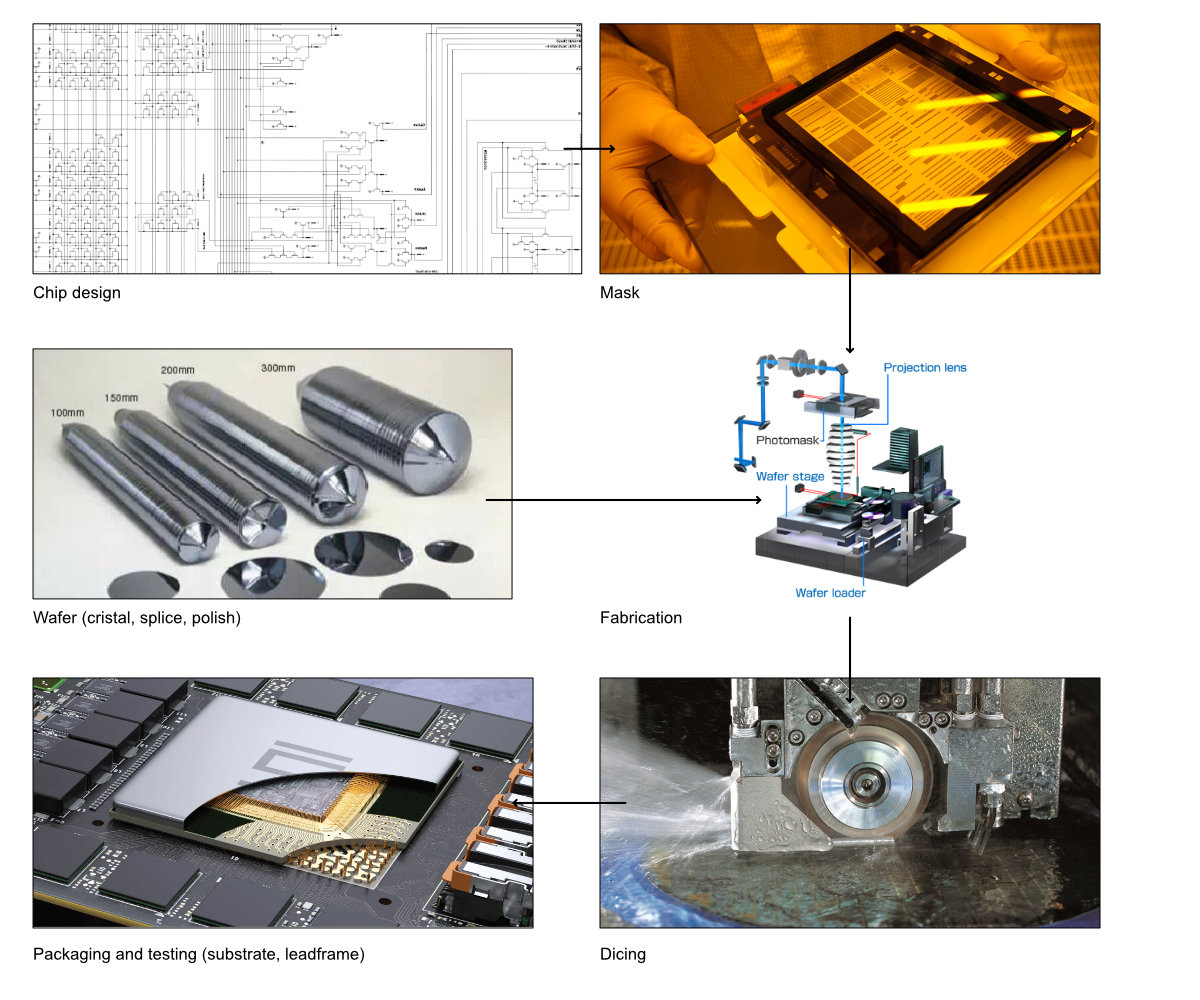

Manufacturing process for ICs

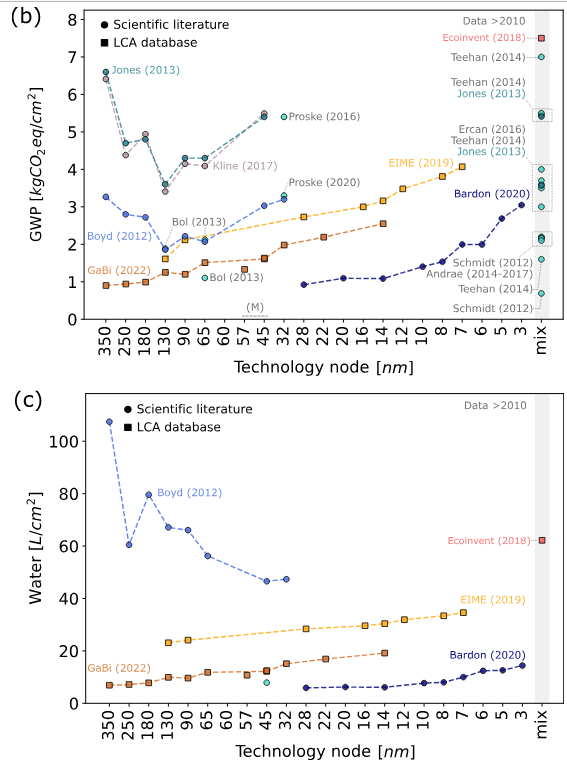

Processors are etched on silica disks, called wafers, doped with another element (e.g. Boron) to modulate their electrical and structural properties. The electronic circuit patterns are affixed to masks that guide the etching, like the negative of a photograph. A wafer allows many circuits to be etched at once, and these circuits are cut with a saw. They are then packaged, i.e. the component connectors are plugged in and tested, and placed in a plastic frame to prevent damage. These components are then sent downstream to the other industries to be soldered onto a circuit board.

Simplified processes for making ICs, see high-res here

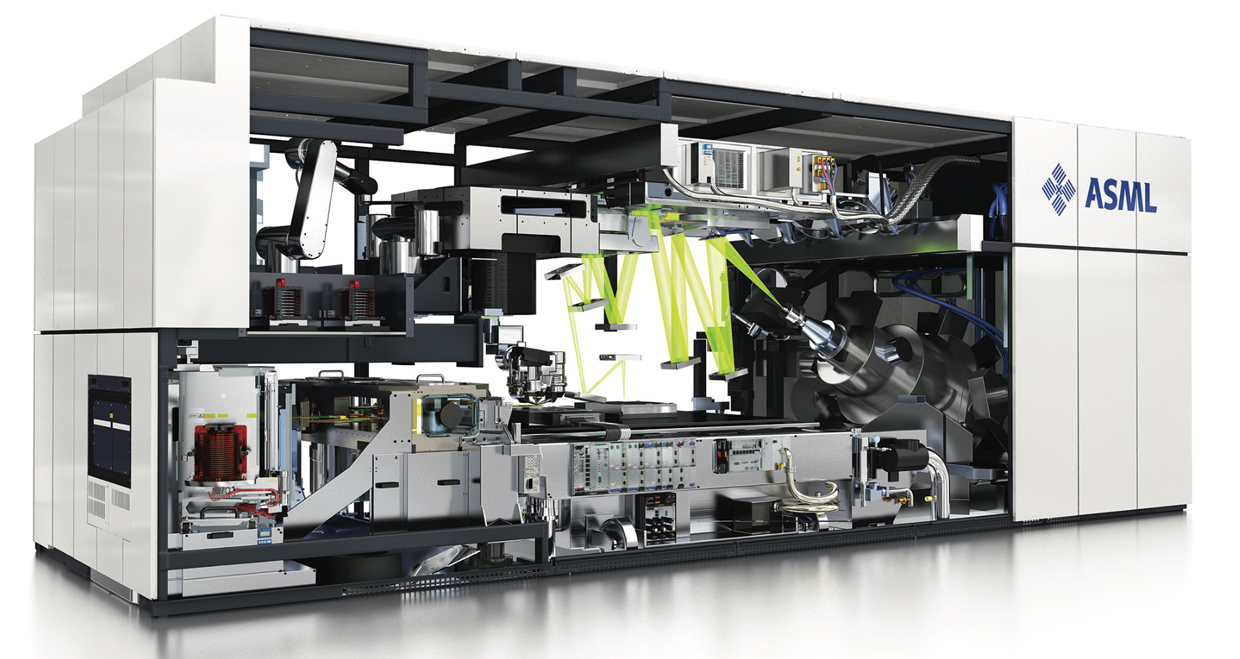

The machines that allow this type of production are very expensive, especially those for engraving. Every year manufacturers produce smaller transistors and can therefore fit more on the same surface. The more transistors there are, the more computing power there is. Today, the most advanced methods engrave at 5nm (the distance separating each transistor from the other) but the physical limit is 2nm and we will reach it within a decade. Today, there is only one type of process that allows us to etch below 7nm, and that is Extreme Ultra Violet. Only one manufacturer produces machines using this process, ASML, and 90% of the production capacity below 10nm is located in Taiwan

NXE:3400 machine from ASML

Environnemental impacts of engraving

This section uses the research paper from Pirson, Thibault ; Delhaye, Thibault P. ; Pip, Alex ; Le Brun, Grégoire ; Raskin, Jean-Pierre ; et. al. The Environmental Footprint of IC Production: Review, Analysis and Lessons from Historical Trends. In: IEEE Transactions on Semiconductor Manufacturing, Vol. 36, p. 56-67 (2023) http://hdl.handle.net/2078.1/268615 -- DOI : 10.1109/tsm.2022.322831

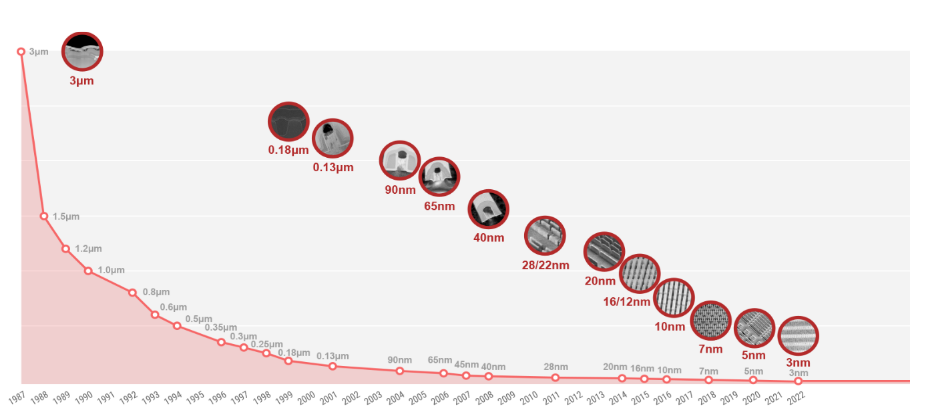

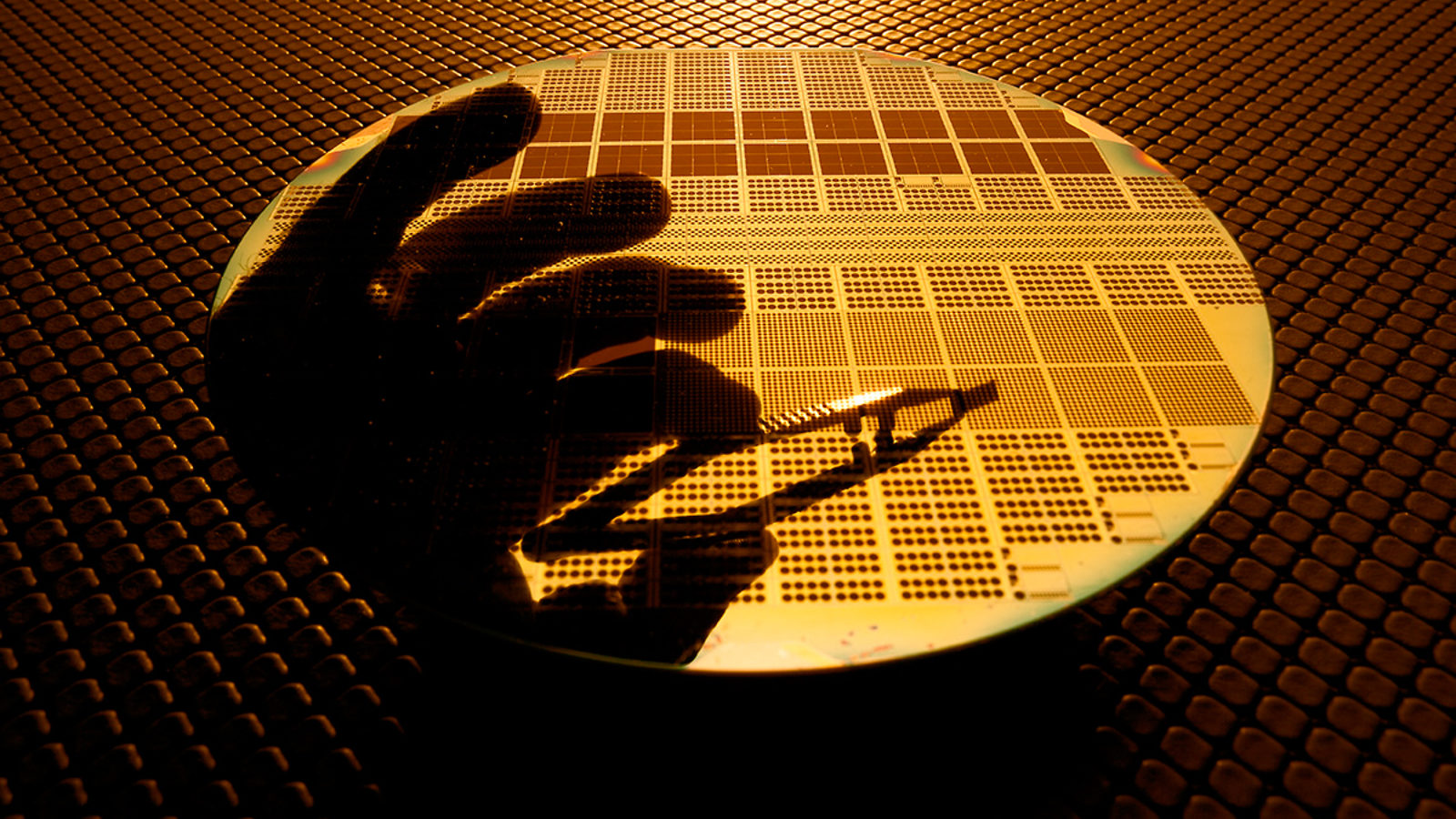

Technological advances have led to a reduction in engraving size. However, this reduction implies an increase in the industry's use of resources (water, energy, gas, etc.) and the associated environmental impact.

In conclusion, [...], we show that the environmental impacts per area are clearly increasing with technology downscaling below 0.13 μm. This is observed both in the scientific literature and in LCA databases, despite the scope mismatch. It also seems that this increase is accelerating for advanced nodes

Node-wise trends based on data from the scientific literature and the LCA databases. This shows the environmental impacts per cm2 with respect to (b) GWP, and (c) water consumption

In addition to the relative impacts increase in engraving per unit area, the size of chips tends to increase in order to accommodate an even greater number of transistors.

Transistors count and die size per release date for CPU (blue) and GPU (orange), chip-dataset

Thus, although the environmental impact per transistor, or more generally per unit of computing power, is decreasing, the environmental impact of chips is also increasing significantly, as is the number of chips produced, which is leading to an increase in the global impact of the semiconductor industry. This is a classic example of the rebound effect.

The case of Taiwan

This section uses the research paper from Gauthier Roussilhe, Thibault Pirson, Mathieu Xhonneux and David Bol, titled: From Silicon Shield to Carbon Lock-in? The Environmental Footprint of Electronic Components Manufacturing in Taiwan (2015-2020) (Link to preprint).

Over the last four decades, Taiwan has developed a strong ecosystem in semiconductor manufacturing, building a leadership position in packaging, foundries, and testing of integrated circuits (ICs). The island is a key provider of electronic components for the rest of the world with more than 63% of the 2021 worldwide output value ensured by Taiwanese IC foundries and 58% of the IC packaging. The electronics industry accounts on average for 30% of Taiwan’s exports and it is therefore not surprising that it significantly contributes to the economy of the island. In fact, Taiwan’s semiconductor industry has witnessed double-digit growth for three consecutive years and is forecasted to reach more than 170 billion US dollars in 2022. The Taiwanese government heavily relies on the electronics industry for the next decades, as it plans on establishing several semiconductor initiatives and R&D programs to support its growth. In parallel, the Taiwanese government has issued a carbon reduction plan called the Greenhouse Gas Reduction Action Plan, with the objective of decreasing their absolute carbon footprint at the 2050 horizon. Yet, Taiwan has been struggling with the effective implementation of this plan and actual carbon reductions are still to be realized. As the production of electronic components is known to be energy and resource-intensive, their environmental impacts cannot be ignored.

Western economies as both the USA and the European Union (EU) are currently massively investing to relocate the manufacturing of advanced manufacturing processes in their own territory (European Chips Act). It is clear that the EU aims at fostering a large digital innovation capacity based on a resilient semiconductor ecosystem. A key policy objective is to eventually bridge the gap from lab to fab by producing CMOS chips in European foundries in order to secure its electronics supply chain and boost its competitiveness through digitalization. This is further supported by the recent chip shortage which revealed the increasing pressure on our production systems. Analyzing the current Taiwanese situation can provide a good estimate of the environmental impacts associated with the development of current and future state-of-the-art electronic components, given that more than 90% of the worldwide sub-10nm integrated circuits (ICs) are currently manufactured in Taiwan at TSMC, the de facto world leader in advanced ICs manufacturing.

Up to 97.5% of Taiwan’s energy generation originates from imported carbon-intensive energy sources in 2020, including coal from Australia, Indonesia and Russia, crude oil from Saudi Arabia, Kuwait and US and liquefied natural gas (LNG) from Qatar, Australia and Russia. Regarding specifically the production of electricity, the Taiwanese government plans to phase out nuclear power and to produce 20% of its electricity from renewable sources by 2025, under the so-called 2017 Electricity Act. Yet, renewable energy represented less than 6% of the power generation in 2020. In fact, as of 2020, only 9.47 GW of renewable energy capacities have been installed in Taiwan (including 5.82 GW from photovoltaic power and 0.85 GW from onshore and offshore wind power). Renewable energies generated that year 15.12 TWh of electricity, whereas the sole electronics sub-sector consumed 50.73 TWh. Due to the limited usable space on the island, the Taiwanese government mainly counts on offshore wind turbines in the future, with a target capacity of 5.7 GW by 2025. Yet, by June 2021, only 0.13 GW have been installed.

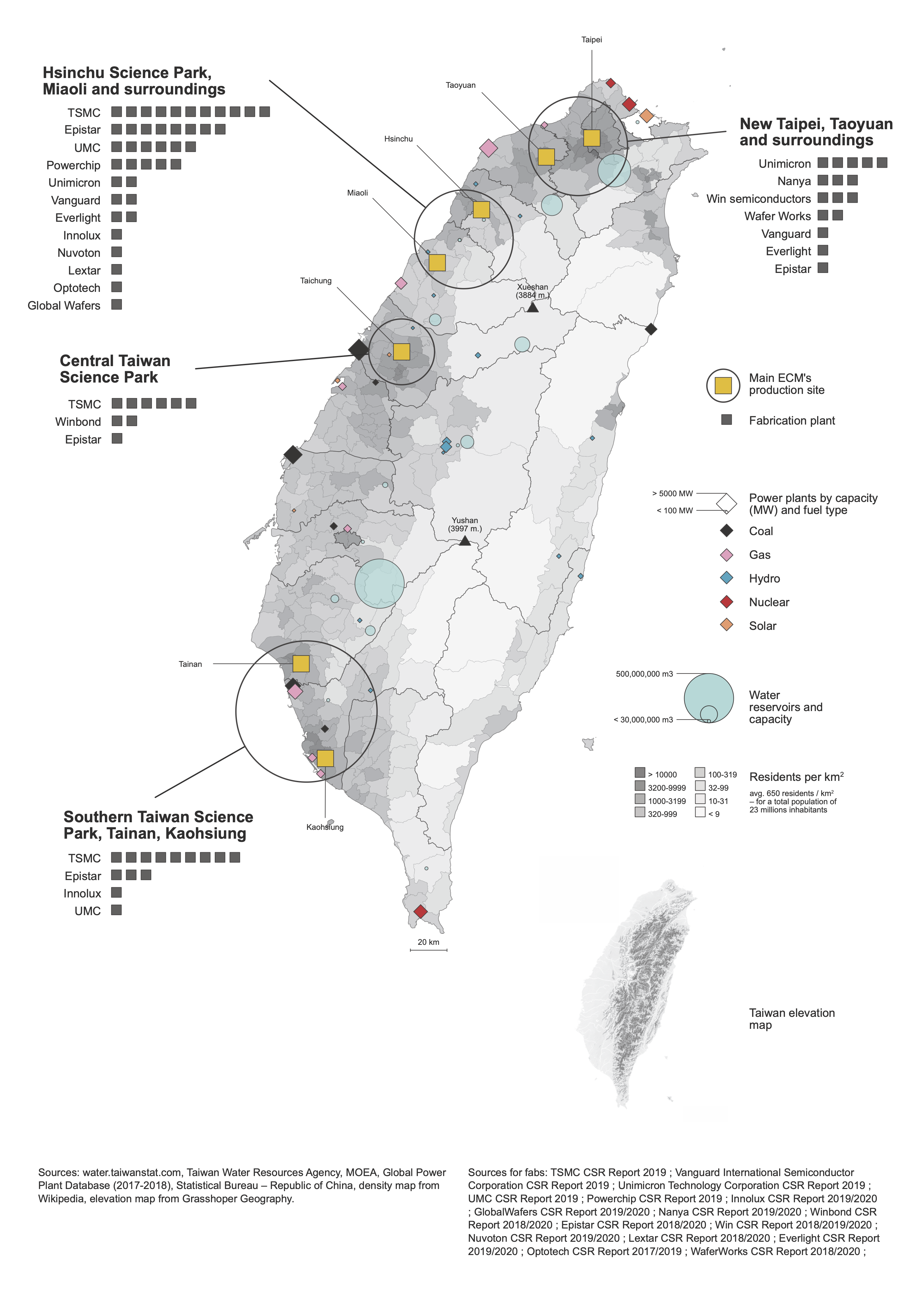

Location of companies considered in this study together with power plants and water reservoirs compared to population density

Even if ECMs do not represent a significant part of the national water intake, they rely on a limited number of reservoirs located in places of very high population density. For instance, TSMC’s factories in Hsinchu Science Park use 10.3% of the daily supply from Baoshan and Second Baoshan reservoirs whereas those located at STCP (Southern Taiwan Science Park) use 5.3% of the daily supply from Nanhua and Zengwen reservoirs. This concentration has already led to supply issues during droughts. In 2020, the island faced a drought caused by the absence of typhoons in the previous year. If ECMs were already facing stress in the water-intensive production chain, this drought seriously amplified the crisis in this key sector of the island. Indeed, TSMC relied that year on hundreds of water trucks to maintain its water supply while several restrictions where being taken at the national level. In this sense, Taiwanese ECMs share a liability regarding water supply due to the increasing and spatially concentrated demand in the Science Parks.

4 - Distribution

Digital equipment has a limited lifespan, and the pace of technological development is rapid (for example, one smartphone version per year). In order to match this pace, it is essential for the manufacturer to reduce the delay between production and market availability. The majority of digital equipment is shipped from Asia. In the European and American markets, air freight is frequently used because it can significantly reduce delivery times. In contrast to the more protracted nature of sea freight, which can take several days (20-30 days), air freight can deliver within a matter of hours (24-48 hours).

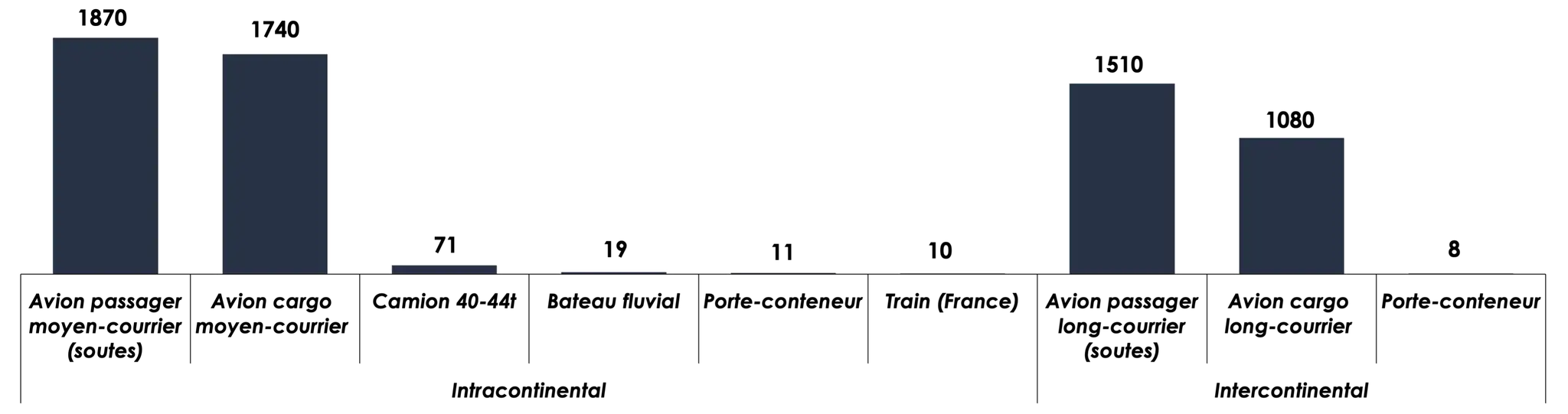

This is a significant issue since air transport is the most impactful mode of transport per t.km in terms of green gas emissions when compared to terrestrial or sea transport.

Distribution of tonne-kilometers worldwide in 2019, from top to bottom, OECD from Carbone4, link

Distribution of tonne-kilometers worldwide in 2019, from top to bottom, OECD from Carbone4, link

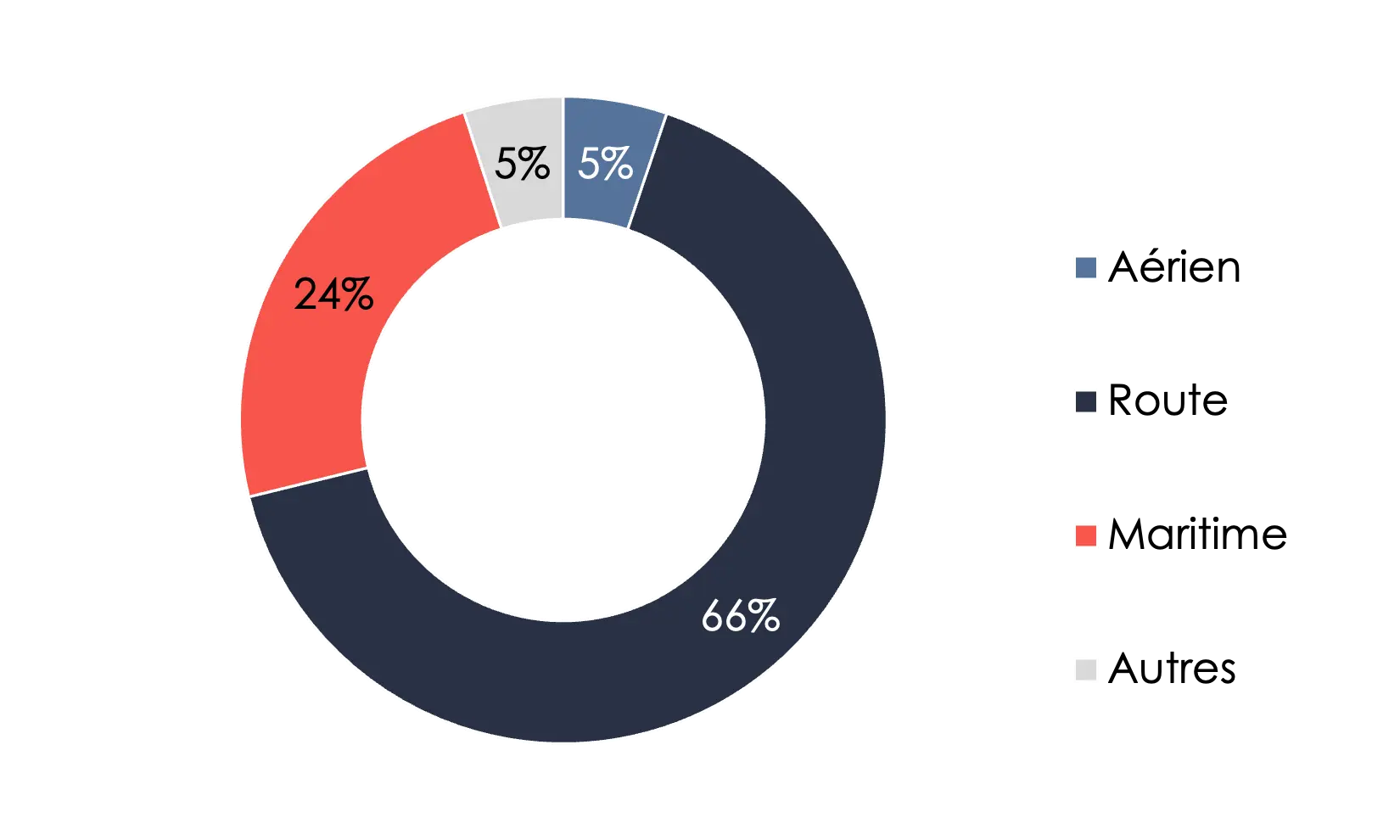

This shouldn't suggest that, in absolute terms, air freight is driving the impacts of goods transport, which is mostly driven by the absolute volume for sea freight and the impactfulness for trucks.

Distribution of global CO2 emissions from freight transport in 2018, from top to bottom: Air, road, sea, other, AIE from carbone4, link

Distribution of global CO2 emissions from freight transport in 2018, from top to bottom: Air, road, sea, other, AIE from carbone4, link

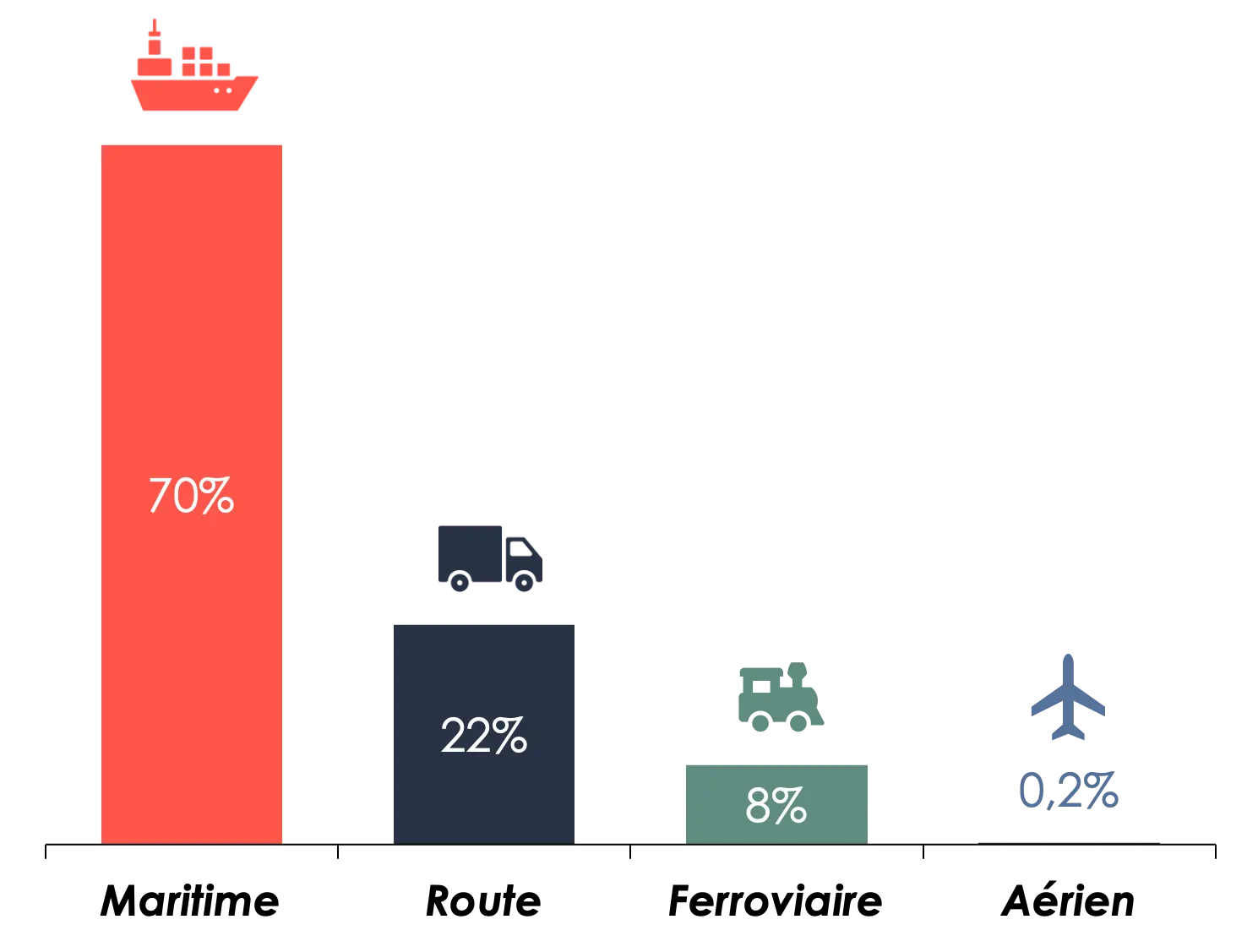

Distribution of tonne-kilometers worldwide in 2019, from left to right : Sea, road, train, air, OECD from carbone4, link

Distribution of tonne-kilometers worldwide in 2019, from left to right : Sea, road, train, air, OECD from carbone4, link

In addition to the direct emissions resulting from the transportation of digital equipment, digitalisation by its important share in air freight is contributing to the sustainment and expansion of air transport infrastructures. This sector is responsible for 2% of global greenhouse gas emissions and 5% of the global warming potential.

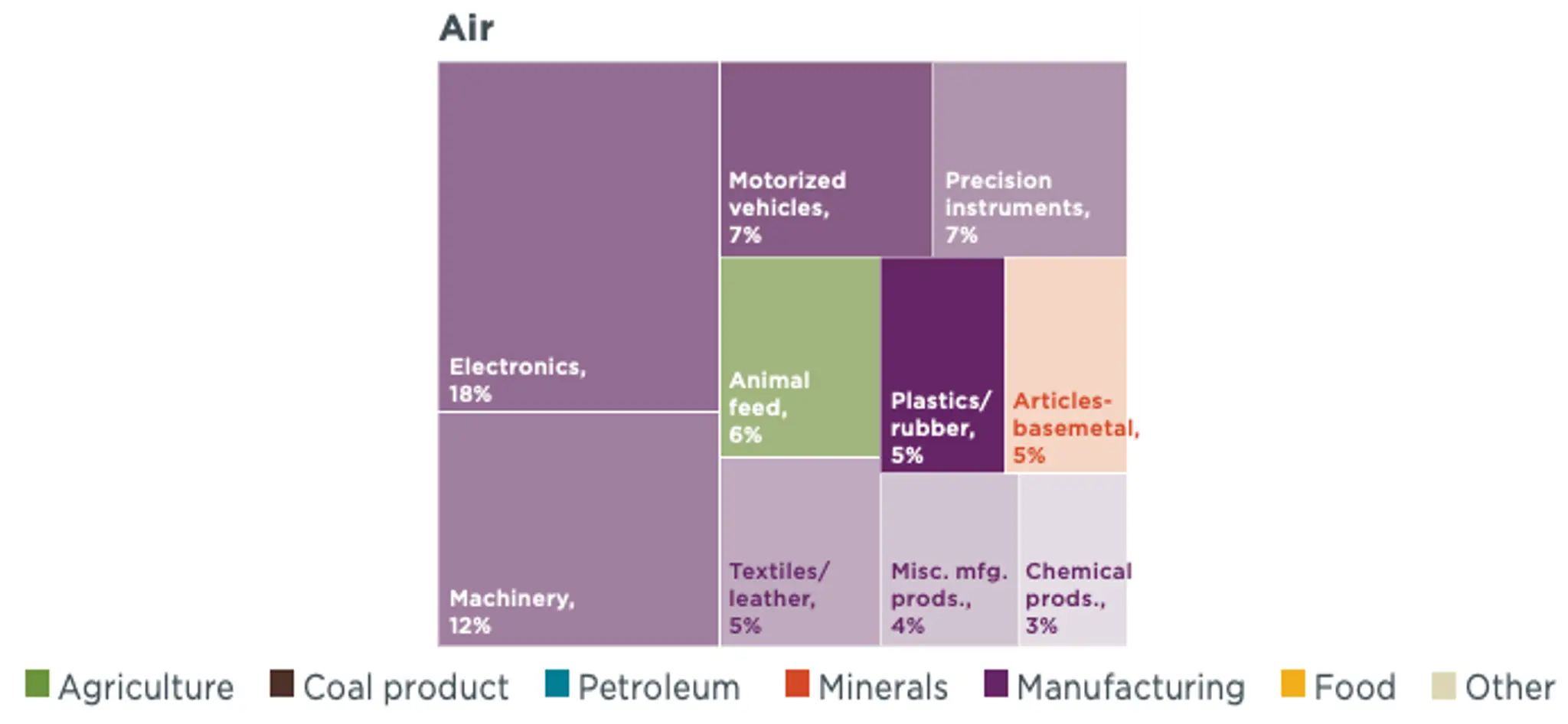

Top 10 commodities shipped by air freight to the United States in 2018 (% by weight) ICCT, 2022, Toward greener and more sustainable freight systems

Top 10 commodities shipped by air freight to the United States in 2018 (% by weight) ICCT, 2022, Toward greener and more sustainable freight systems

5 - Deploy and use

We have already explored this stage during Session 2, Session 3 and Session 4.

6 - End-of-life

One solution often put forward to address the environmental challenges of the digital value chain is better end-of-life management through repairing, refurbishing or recycling. However, there are many challenges throughout the end-of-life process that make it difficult, and sometimes impossible, to implement these practices on a large scale.

Obsolecence

Digital equipments have a particular short lifespan. This is explained by serveral types of obsolences. This short lifespan increases the pressures on the upstream value chain of the ICT industry.

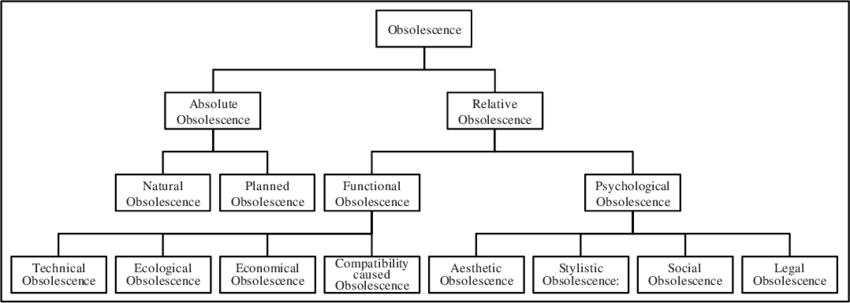

Overview over types of obsolescence, Daniel Schallmo, 2018, link

Overview over types of obsolescence, Daniel Schallmo, 2018, link

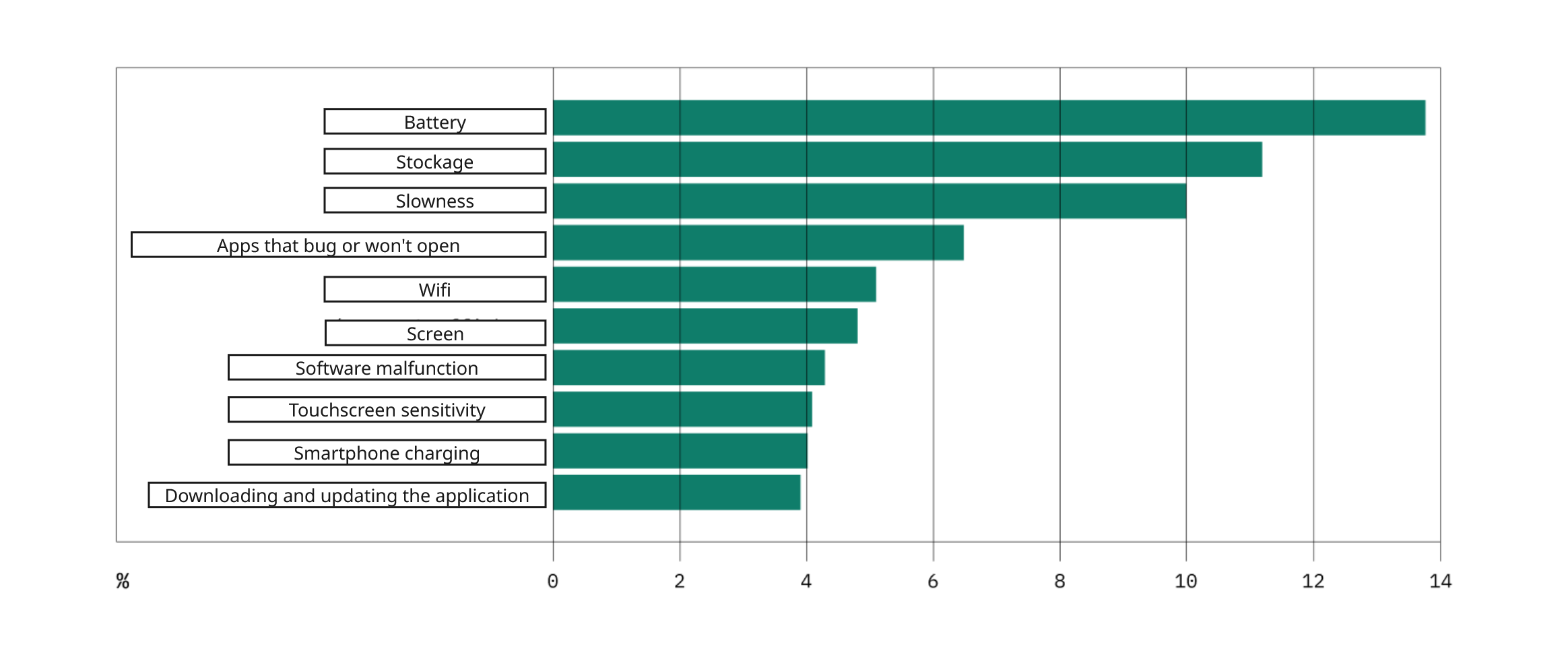

The case of smartphones is particularly relevant because they have a relatively short lifespan (around three years on average in France). A recent study by Limite Numérique highlights the sources of technical obsolescence. It shows that the technical obsolescence of smartphones is driven by constraints in both the hardware and software. The study therefore calls for the design of equipment and software that considers the issue of hardware durability.

The main problems encountered by smartphone owners

The main problems encountered by smartphone owners

This study therefore calls for facilitating hardware repairs, but also resolving software issues by taking into account not only updates, but also storage saturation and slow terminals.

It identifies several levers for action, particularly for designers, developers, and digital service designers:

- Implement a software warranty from smartphone manufacturers, covering several years.

- Provide lighter, less data-intensive applications that do not saturate storage, are compatible with low computing capacities to avoid slowness, and preserve battery life.

- Facilitate storage management and make the data produced by applications intelligible.

- Add settings that allow users to bypass malfunctions and preserve battery life.

- Facilitate hardware and software repair and maintenance: extend repair bonuses to software problem resolution, and design equipment and software that users can repair and maintain themselves.

Repair/Refurbish

In order to extend the lifespan of digital equipment, repairing and refurbishing practices are essential. However, these activities, even if beneficial from an environmental point of view, have their own impacts.

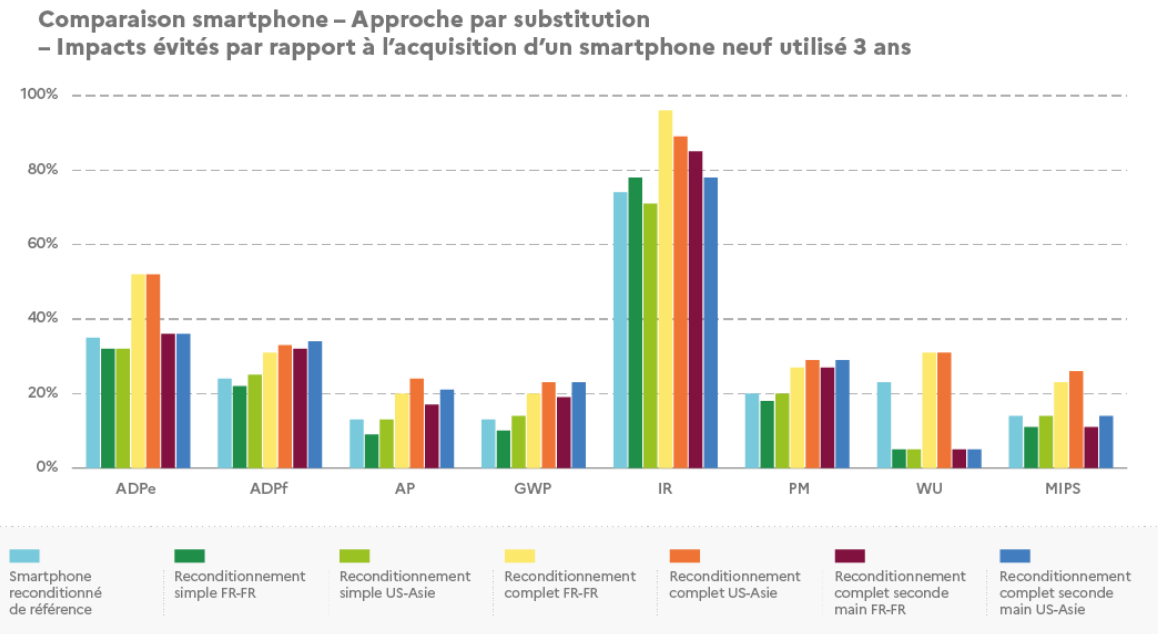

Smartphone comparaison - Impacts avoided compared to purchasing a new smartphone used for 3 years, ADEME, 2023, link

Smartphone comparaison - Impacts avoided compared to purchasing a new smartphone used for 3 years, ADEME, 2023, link

In addition, these practices depend on the availability of parts, which in turn depends on manufacturer policy. Furthermore, given that many manufacturers release a wide range of products at high deployment rates, it is not straightforward to industrialise repair and refurbishment practices, which often limits their large-scale deployment.

The sector is also very heterogeneous, with small social economy actors competing with multinationals. Competition for deposits and industrialisation is becoming increasingly difficult for smaller players.

Recycle

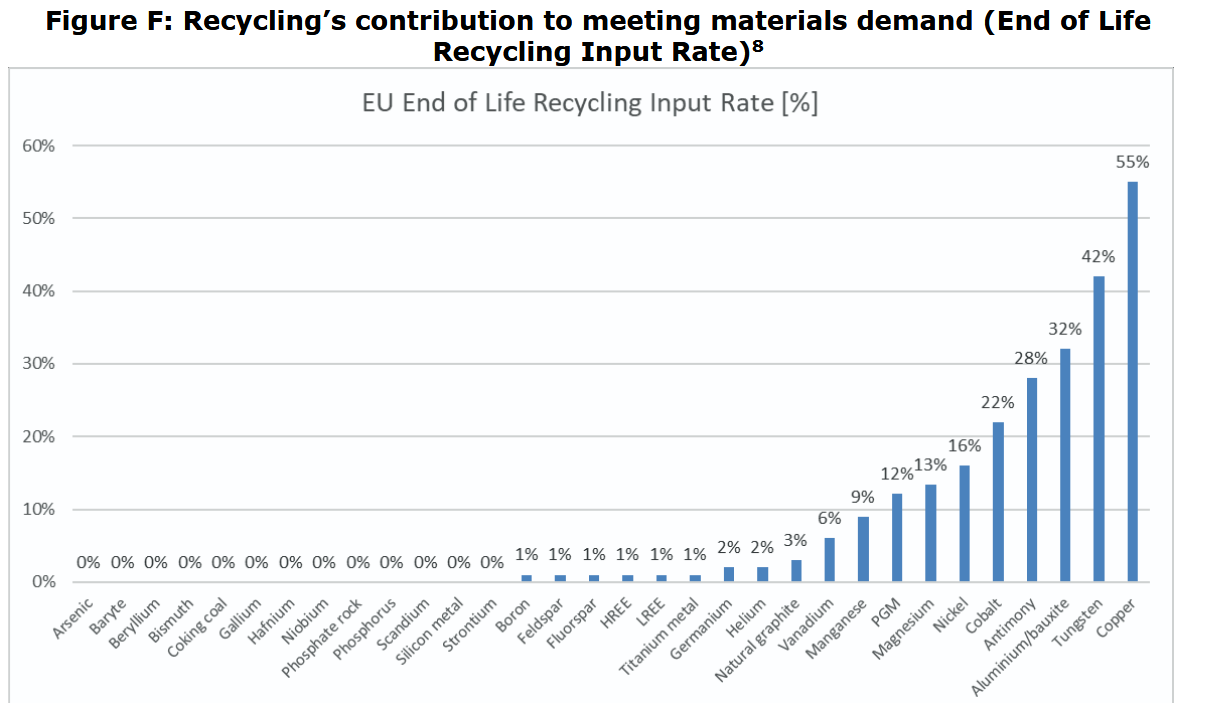

Faced with the constant increase in material consumption, recycling electronic waste seems to be a promising option. In Europe, recycling is promoted as a means of addressing environmental and sovereignty issues, but its application depends heavily on the type of metals involved. With the exception of structural metals (aluminium and copper), metals used in digital technology are almost never recycled.

Recycling's contribution to meeting materials demand, Study on the critical raw materials for the EU 2023

Indeed, the metals present in digital equipment are difficult to recover and recycle because they are present in too small quantities or because they are used in an alloy and cannot be separated.

In addition to these technical constraints, there are also economic constraints. Recycling industries have to invest much more to recover metals than other industries: "Florian Fizaine cites the example of the company UMICORE: "One billion dollars has been invested in Umicore's recycling and refining plant operating in Belgium. This plant extracts 30 tons of gold, 37 tons of platinum group metals, 1,000 tons of silver and 68,500 tons of other metals per year from scrap. This makes it the third largest gold mine in the world [...] By comparison, a paper recycling plant only requires an investment of 30 to 50 million dollars" (France Stratégie).

There are few industries specialized in the recycling of electronic waste. Umicore's Hoboken site recovers some 17 metals from over 200 complex input streams from all around the globe. 400,000 t of feed-materials are treated annually (2017) and this plant is one of the world’s largest precious metals recycling facilities with a capacity of over 50t PGMs (Platinum Group Metals), over 100t of gold and 2400t of silver (2007 numbers). The Hoboken plant is profitable due to the recovery of gold, silver and platinum which are on average 7 times more concentrated in e-waste than in a conventional mining site. Despite this ability to recover some metals from the complex waste stream, the mineral demand is so large and diverse that we cannot function without extracting more and more material. For instance, we have never recycled copper so well, yet we have never extracted as much as we do today.

We can explain the recycling rate of metals by their price, their concentration in the product, and the relative metal concentration between products and primary deposits. The marginal response of the recycling rate to price seems to be low, regardless of the specification and the model used. At best, tripling price corresponds to an increase of +7.9 point of percentage of recycling rate. This finding is in line with the sparse literature on metal recycling flow. [...] an addition of one percentage point of metal concentration is correlated with a rise in the metal recycling rate of 2.52 percentage points. (Fizaine, 2020)

The impacts of recycling

Without collection and treatment, electronic waste is generally sent through informal or illegal channels to countries in Africa, South America or South East Asia. The metals and materials they contain are then extracted in conditions that are dangerous for human health and ecosystems. Today, it is estimated that 80% of electronic waste goes through informal channels.

If illegal disposal is subject to important social and environnmental dommages, legal pathways are also subject to environnmental controveries.

Umicore electronic waste recycling facility in Hoboken, Belgium

Processing the waste requires energy, water and many chemicals to separate the metallic elements. Normally, the wastewater is partly recycled and a third is discharged into the river next to the plant. However, the plant is tied to an environmental justice movement because of the pollution it is said to cause. Numerous NGOs have documented for years the pollution originating from the plant, the contaminations and the cancer cases that were allegedly caused by Umicore.

The limits of recycling in the context of growth.

Digital technologies increase the pressure on small and rare metals while including them in products that are not designed for resource recovery. Recovery of small and rare matelas through recycling is now extremely limited except for a few high-value metals like gold and platinum.

In the end, recycling is not a long-term solution and the crux of the problem is the increase in consumption which leads to an increase in extraction, whether we have an efficient recycling chain or not. A constant growth of the couple production/consumption will inevitably be linked to an increase of pollution in water, air and soils affecting the ecosystems and communities where the extraction and waste disposal activities are located.